EMB Newsletter July/August 2020

Newsletter as PDF

Contact

EMB - European Milk Board asbl

Rue de la Loi 155

B-1040 Bruxelles

Phone: +32 - 2808 - 1935

Fax: +32 - 2808 - 8265

Dear dairy farmers, dear interested parties,

Over the last few days and weeks, many have added their voices to the chorus of those who see a recovery on the milk market. If you were to listen to dairies and processors, you would think that everything is back on track. Farmers’ associations, retailers and a broad range of policy-makers are singing along to this hopeful tune. Are we from the EMB just inciting panic?

It would seem that the opening of private storage has solved all the world’s problems. The agricultural press is talking about a “noticeable recovery” and “positive trends”. Some fellow farmers do, in fact, believe that yet another ‘competitor’ going out of business is a positive trend, and are dutifully keeping their production going as usual. And, thankfully, we can travel again. So, we farmers will not have to reschedule our two to three weeks of well-earned time off.

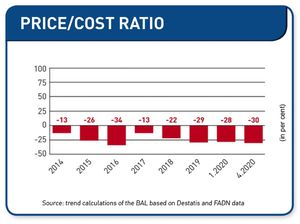

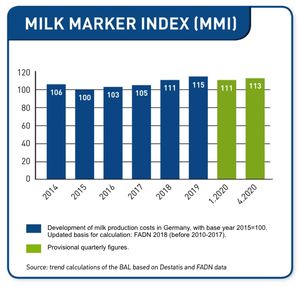

It surprises me to see that people think that dairy farmers can be so quickly and easily calmed down. All you need to do is look at the milk price. In many places, it is already below the 30-cent threshold – which is also psychologically very important – and this in the face of total production costs amounting to almost 45 cents. Stocks in warehouses are growing every week and exert additional downward pressure on the price. In some countries, the quotas for cheese were entirely filled in the first few weeks. If all of this was not enough, too many farms are suffering major liquidity crunches. Most of them are merely one step away from heading to the bank – that is, if new loans are even being granted. Even though all of this sounds like anything but “recovery”, the chorus of appeasement is only growing.

But we at the EMB are going to continue to make our position heard – loud and clear. As long as prices are in a downward spiral, with production continuing full-steam ahead nonetheless, and there is no effective crisis instrument at EU level, nothing is really on track. When the imbalance is as grave as the current situation, a reduction in milk volume is the only way to bring some relief. Together with our 21 member organisations from 16 countries, we stand united behind this message. Inciting panic is far removed from our intent. With our Market Responsibility Programme, we are ready to make a constructive contribution to the debate towards finding an effective solution. It is quite clear that unless production is reduced, the current issues will persist for a long time and one dairy farm after the other will be driven into the ground.

As the EMB, we stand in solidarity with all European dairy farmers. In the context of the European Commission’s new sustainability strategy, we must preserve our family farms – each and every one counts. But this survival hinges on producer prices that cover our production costs in full and allow us to draw a decent income. Sustainable farming is only possible if it encompasses the well-being of farmers, consumers and society.

But if our message falls on deaf ears, perhaps we will, once again, need to make ourselves heard in Brussels in the near future. Speaking of travel, the EU capital has always been just a tractor-ride away!

Erwin Schöpges, President of the European Milk Board (EMB)

Price/cost ratio in Germany almost at 2016 crisis level

In search of courageous ministers: the crisis on the dairy market is getting worse, but policy-makers look on passively

Trial of origin labelling for milk and meat extended to the end of 2021

Latest information from Germany

Nitrates Directive: information from countries

Interview with Adrien Lefèvre, Vice-President of FaireFrance

Swiss dairy farmers are being swindled yet again

Impressum

European Milk Board asbl

Rue de la Loi 155

B-1040 Bruxelles

Phone: +32 2808 1935

Fax: +32 2808 8265

E-Mail: office@europeanmilkboard.org

Website: http://www.europeanmilkboard.org