EMB Newsletter November 2021

Newsletter as PDF

Contact

EMB - European Milk Board asbl

Rue de la Loi 155

B-1040 Bruxelles

Phone: +32 - 2808 - 1935

Fax: +32 - 2808 - 8265

Dear dairy farmers, dear interested parties,

Autumn has arrived and I hope you were all able to finish (most of) your harvest. I also hope your yields have met your expectations in spite of the many weather events that have marked this year: late frost, a cold-humid summer with extreme floods on one side of Europe, and prolonged heatwaves, droughts and wild fires on the other.

On the political level, our farmers can feel the new CAP wind picking up as its national strategic plans are being finalised and the Green Deal is on its way. Mr. Timmermans had made a commitment to conduct a thorough assessment of the European strategy, but never followed through with it, giving rise to a host of questions being raised within the farming and agri-food community. More than ever, if we are being called upon to comply with this “Farm to Fork” rationale and the Green Deal approach, we can only do so on one condition: we must be able to bear the additional costs this strategy will generate. Our reasoning remains the same: we want to be able to cover our milk production costs and to earn a decent living to support our families. That is all we ask for.

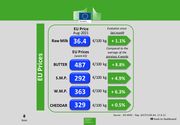

I would also like to touch upon some of the latest developments on the milk market. Milk supplies have slightly decreased in some major producer countries (-1 to -2%), a trend we haven’t witnessed in a long time. As a direct consequence, the spot market price is close to € 0.50 per litre and yet no financial compensation is being paid to producers. In Belgium, butter currently costs 4,320 euros per tonne and milk powder 3,370 euros per tonne. In the future, it would be interesting to have a continual comparison between the prices paid to producers and butter and powder price quotations. Such a comparison could raise eyebrows because in the long term the result won’t always be logical.

As a matter of decency, we should be receiving a fairer price that reflects producers’ work, especially when our production costs go through the roof (+20%). In Belgium, we are currently receiving € 0.35 per litre of milk supplied at 4.2% fat and 3.4% protein. However, our cost study for 2019 already indicated that production costs had reached € 0.47, and this figure is likely to have increased since then. As it is with the Green Deal and despite slim progress made in the Common Market Organisation (CMO) in the CAP, we need political solutions and guarantees. Obtaining them will require us to stay strong, united and determined. Is it not high time we increased our visibility, turned up pressure and remembered that nothing beats getting in the tractor and heading to the place where these decisions are made – Brussels?

Lastly, I’d like to say that mistakes made in the past cannot be repeated, for example the liberalisation of milk production which has thrown many farmers into bankruptcy or into the embrace of the banks. To be truly “sustainable”, the milk sector first of all needs continuity. This means that farms must be passed on from generation to generation, to young farmers who can decently live off their passion on a family farm and in a healthier environment as wished for by our consumers.

Guy Francq, EMB Executive Committee member and President of MIG Belgium

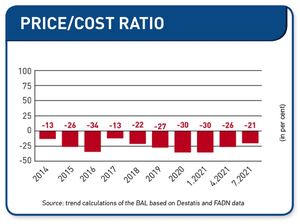

Germany: 21% of production costs not covered by milk price

OPL symposium in Savoie, France: methanation a hot topic

Impressum

European Milk Board asbl

Rue de la Loi 155

B-1040 Bruxelles

Phone: +32 2808 1935

Fax: +32 2808 8265

E-Mail: office@europeanmilkboard.org

Website: http://www.europeanmilkboard.org