EMB Newsletter June 2020

Newsletter as PDF

Contact

EMB - European Milk Board asbl

Rue de la Loi 155

B-1040 Bruxelles

Phone: +32 - 2808 - 1935

Fax: +32 - 2808 - 8265

Dear dairy farmers, dear fellow campaigners,

On 20 May, the European Commission published its ‘Farm to Fork’ strategy. For us farmers, this strategy represents a ‘last chance’ to rebalance the food supply chain – to preserve what’s left of the EU’s family farm system and wrest back control and direction of the EU’s food supply chain from the retail corporations who have the greatest interest in maintaining the present ‘broken’ system.

The challenges facing farming and food production are almost beyond comprehension. More food has to be produced for a growing population but on an increasingly sustainable basis, which means that traditional ways of increasing supply have to be curtailed or discarded. Farmers accept both the scientific reality and the scale of the challenge that has to be met. I am adamant that it is the starting point that is chosen by the EU that will ultimately determine whether or not their ‘Farm to Fork’ strategy is successful. This must mean a reversal of the traditional EU approach whereby the delivery of cheap food at retail level is deemed the most important element with everything else positioned to serve that.

It is precisely that aim that contributed most to, for instance, the stunning levels of food wasted at present – 20% according to the ‘Farm to Fork’ briefing documents.

ICMSA and other farm organisations have long argued that instead of constructing the system backwards from a position that prioritised retail of high standard food at cheap prices, the system should start with the sustainability of both the food and the farming communities who produce it.

Reforming our present broken food supply system is like reforming any other seemingly intractable problem: the first step is the vital one. If that first step is wrong, then every step after it brings you further away from the solution. The absolutely fundamental question here, and we’ll know the answer tomorrow, is whether the EU’s first step is going to be towards a solution or continuing on the present path that brought us to this cliff edge. The solution has to start with societies and corporations paying the real price of the food they consume: the ‘cheap food’ policy advocated and implemented by the retail corporations and endorsed by politicians has undermined environmental sustainability and utterly destroyed the economic viability of the farming communities that produce our food. That is the place to start and we should move from that position forward.

But if tomorrow we are told that the strategy is going to start from a position that doesn’t see, or want, changes at consumer or retail level, then we’ll know that everyone has wasted their time. Farmers will not accept a strategy that simply imposes further restrictions on them alone, the strategy must ensure a proper price for sustainable food and the use of third-country imports to undermine sustainable food production must be stopped as part of that strategy.

Pat McCormack, member of the EMB Executive Committee and president of the Irish Creamery Milk Supplier Association (ICMSA)

How do you get farmers to effectively engage with the Green Deal and ‘Farm to Fork’ strategy?

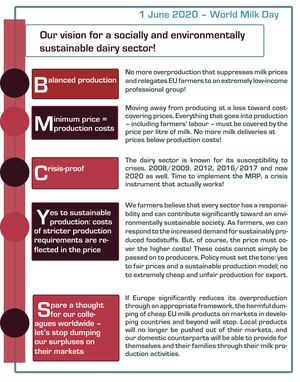

1 June 2020: World Milk Day – Our vision for a socially and environmentally sustainable dairy sector

Latest developments in the milk sector in the coronavirus crisis

All going swimmingly or drowning in milk?

BDM milk powder demonstrations in eight cities

Nitrates Directive: information from different countries

Impressum

European Milk Board asbl

Rue de la Loi 155

B-1040 Bruxelles

Phone: +32 2808 1935

Fax: +32 2808 8265

E-Mail: office@europeanmilkboard.org

Website: http://www.europeanmilkboard.org